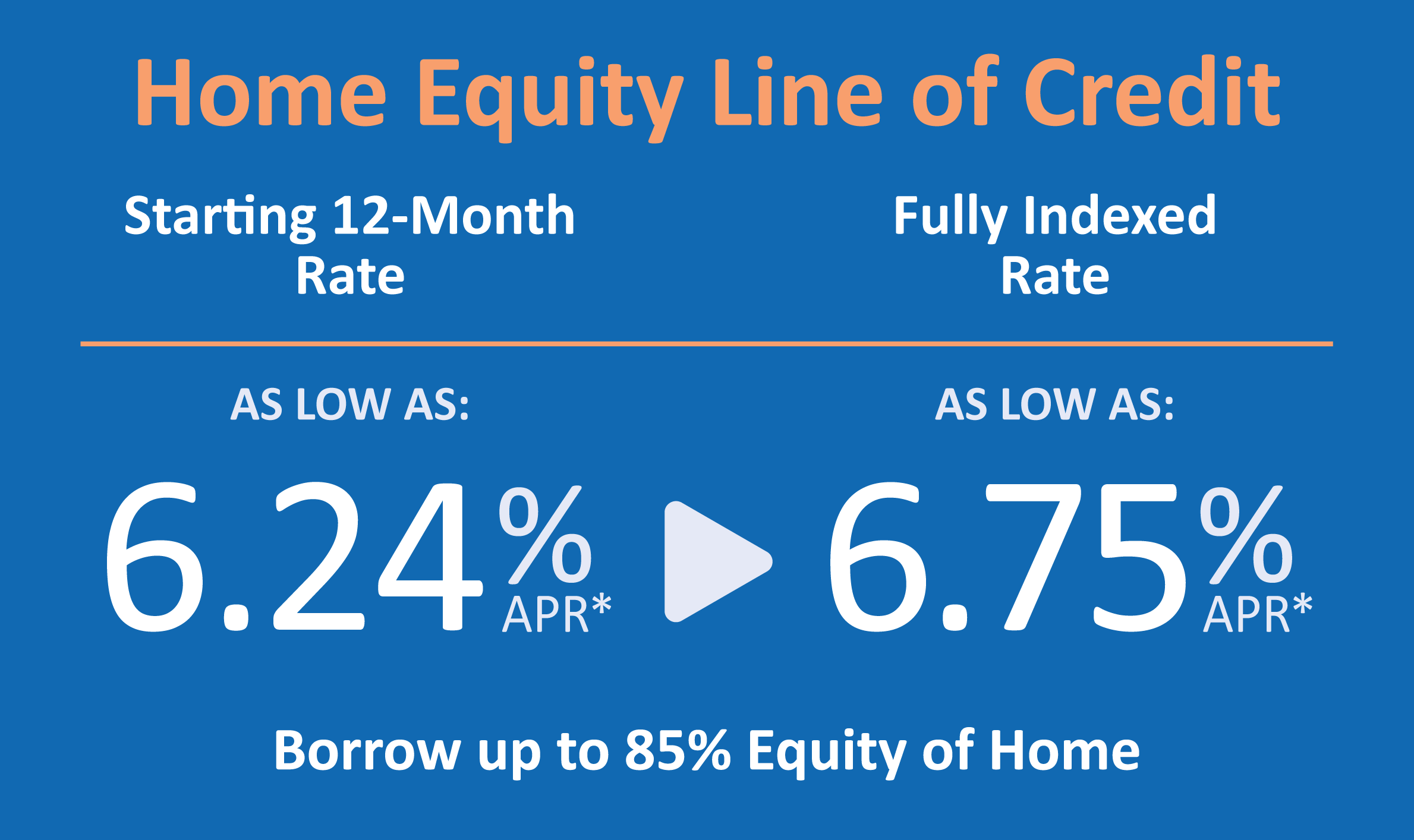

Home Equity Line of Credit

Tap into equity for any purpose

You have big plans. Your home's equity can help pay for them. Make home repairs, consolidate high-interest debt, cover college tuition or pay medical bills. A KeyPoint Home Equity Line of Credit (HELOC) gives you access to the money you need at a low rate, with no annual or early termination fees.

*As of 3/1/2026, 12-month fixed intro APRs from 6.24% to 7.49%; current indexed variable APRs from 6.750% to 7.875%. 4.50% floor APR. Lifetime maximum variable APR is 16.00. Rates offered to approved applicants depend on credit history, loan-to-value ratio and other factors we may lawfully consider. Fees to establish an equity line typically range from $950-$1,500. Equity lines are subject to full appraisal. The fee for full appraisal typically ranges from $600-$900. No annual or early termination fee. For HELOCs over 80% up to 85% LTV, maximum available credit limit is the lesser of $175,000 or available equity. All loans subject to credit approval. Available rates and terms subject to change without notice.

KeyPoint Membership required.