Features | Get Started | FAQs

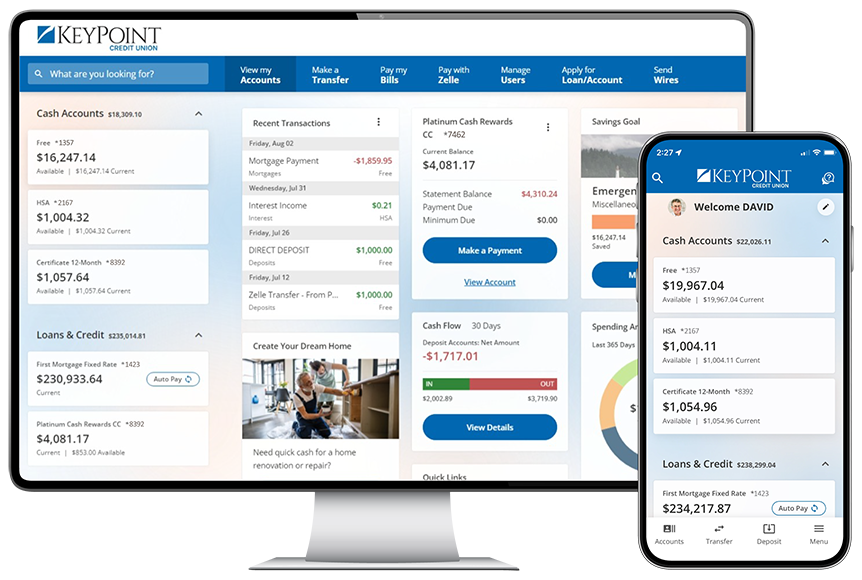

We've transformed Mobile1 and Online Banking to give you the control, access and support you need to achieve your financial goals. Enjoy new, cutting-edge features like financial health tracking and enhanced card controls alongside all the familiar favorites—Zelle®2 , Bill Pay, mobile deposits and more!

New Look. Enhanced Features. More Control.

- Track Your Finances

- Enjoy everything you need in one place! Access all your accounts and customize your dashboard to fit your needs.

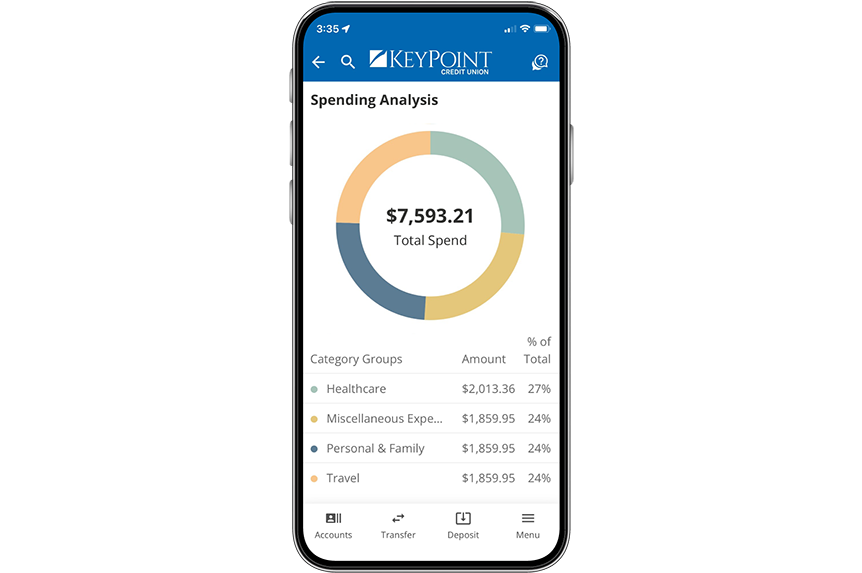

- Get Financially Fit

- Check your financial pulse with personalized spending insights and tools to help you save for what’s important—a wedding, new home, retirement and more!

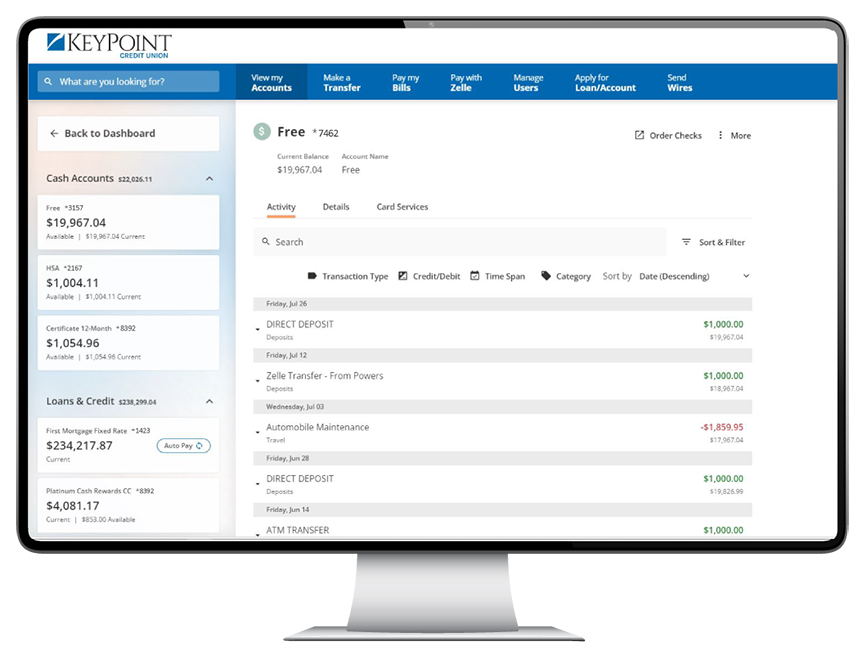

- Faster Account Management

- Say hello to new features that help you search past transactions, view mobile deposit images and create custom wire templates.

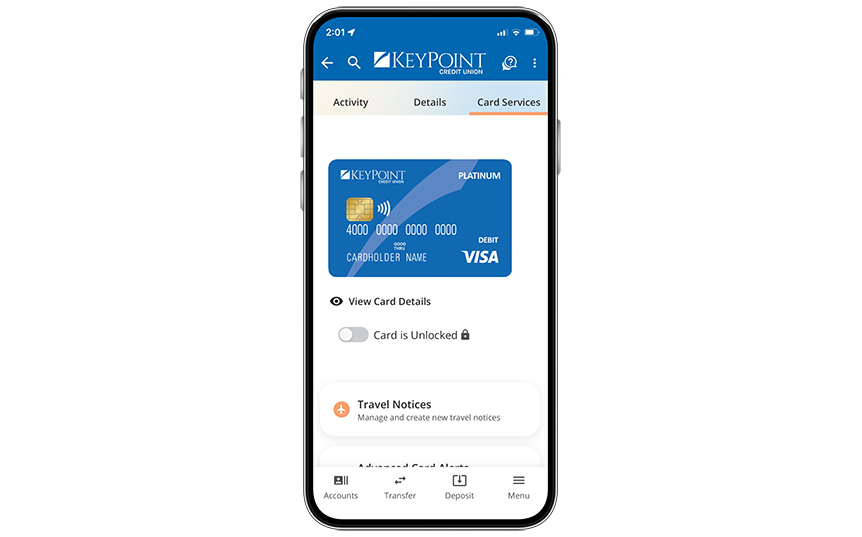

- Anytime Access

- It’s official—KeyPoint Cards is available on Mobile and Online Banking! Easily manage your cards and get real-time alerts sent by email, text or push notification.

1Mobile carrier rates may apply. 2Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Get Started!

Primary and Joint Account Holders: Follow the steps provided to verify your identity. While your username will not change, you will need to set up a password. (Financial application users such as Quicken, Plaid, Yodlee, etc. will also need to update your password in the application.)

- Using Online Banking?

- Visit kpcu.com to log in for the first time (and update your Online Banking bookmark).

- Using the Mobile app?

- Update your app to the latest version or log in if automatic updates are enabled.

![]()

Bill Pay, Move Money and Zelle®

Your existing history and settings for these features will carry over to the new platform.

How to Setup

Confirm any scheduled transfers you may have.

![]()

Face and Touch ID

Re-enable your Face or Touch ID.

How to Setup

Turn on Face or Touch ID when you log into the new platform.

![]()

Alerts

Re-establish your current account and card alerts.

How to Setup

In the new platform, visit Menu and Alerts. You can also choose how you’d like to receive alerts—whether by text, email or push notification.

![]()

Intuit (Quicken & QuickBooks)

Re-sync your Intuit program to ensure your data transfers smoothly.

How to Setup

Follow the Intuit provided instructions below.

![]()

Share Access

Re-assign permissions for those with shared account access.

How to Setup

When you first log in, go to Manage Users to re-assign permissions.

3If you have any questions regarding instructions, please contact Intuit.

Frequently Asked Questions

First-Time Login

Business accounts with an Employer Identification Number (EIN) will have a separate login from Personal accounts.

NOTE: Your login credentials will remain the same on the new platform.

You can enable two-factor authentication, push authentication or an Authenticator app to enhance your security strength. In your account's “Security Validation” settings, you can choose to verify your identity at every login or on occasion.

NOTE: Your initial login from a new device will require security code verification.

Here is a list of required criteria to help keep your account secure. Your password must:

- Have between 8-32 characters

- Contain at least one letter

- Contain at least one number

- Contain only the following special characters !@#$%^&*()|-_+=[]{};':",.<>?/`~

Current Members will not need to “re-register.” Instead, you will log in with your current username and password and confirm your identity via a few authenticating questions before being prompted to change your password.

NOTE: You may reuse your existing password if you wish.

Online Banking supports the last two versions of Microsoft Edge, Safari, Chrome and Firefox. The TOR browser cannot be used. Additionally, the Mobile app supports the last two versions of iOS and Android.

- If you’re the primary account holder: Follow the steps provided to verify your identity. While your username will not change, you will need to set up a password.

- If you’re a joint account holder: You'll be able to have your own login. Follow the steps provided to confirm your identity and create a new password.

If you have automatic updates enabled, the latest version will be available automatically. Otherwise, update the Mobile app in the App Store or Google Play. The app icon will have a white square (not blue).

NOTE: If you see the former app icon or receive a connectivity error, you may need to delete and reinstall the app.

You will only need to set up or re-enter information for a couple of services once the upgraded platform is live:

- Face and Touch ID—Re-enable your Face or Touch ID when logging in.

- Alerts—Re-establish your current alerts to the new platform to receive account and security notifications.

- Intuit—You may be required to make changes to your Intuit application, which includes Quicken or QuickBooks. No action is needed if you no longer require integrating these applications with your KeyPoint account(s). Otherwise, please follow these Intuit transition instructions.

- Share Access—Re-assign permissions for those with shared account access. Go to “Manage Users” to assign permissions.

Card Controls

Be sure to turn off alerts in the KPCU Cards app before setting these up in the upgraded platform. Otherwise, you may receive duplicate card alert notifications.

Your debit and credit card transactions will be available on the new platform.

Bill Pay

You will have access to all your Bill Pay payees and history.

NOTE: KeyPoint requires at least one valid domestic (U.S.) address on file to process Bill Pay, external transfers and Pay Anyone. If you have any questions, contact us at (888) 255-3637 or Live Chat.

Account Management

NOTES: You must activate Financial Wellness/Spending Analysis on your dashboard to filter by “Category.” Additionally, loan payments made as a transfer between KeyPoint accounts will appear under “Transaction Type” > “Transfers.”

You can also sort transactions by selecting the “Sort By” dropdown menu. Sort options include “Date (Ascending),” “Date (Descending),” “Description (A-Z),” “Description (Z-A),” “Amount (Low to High)” and “Amount (High to Low).”

KeyPoint’s Youth Banking program helps students under 18 learn about banking and managing their money with a checking and savings account. Visit kpcu.com/youth to apply.

Still having trouble?

Call (888) 255-3637, click the Live Chat link during operating hours, or click here to request a call back—a Member Services Representative will contact you as soon as possible. You can also find our branch locations, hours and maps on our Locations page.

Write to us at KeyPoint Credit Union, 2150 Trade Zone Boulevard, Suite 200, San Jose, CA 95131.

In addition, some of the PFM services may periodically update their information and attempt to login to your KeyPoint account (even when you are not logging on to your PFM service). KeyPoint will also send you an authentication request to confirm you are authorizing access to your KeyPoint account. Please review these authentication requests carefully. If you decline the authorization request to access your KeyPoint account, for your protection, your KeyPoint account will be locked. Please follow instructions to unlock your account at https://digital.kpcu.com/login-help

At a minimum, with the new system, you will need to go into your PFM tool and re-authenticate your connection back to KeyPoint. Also, please note that many PFM tools perform regular data “pulls” afterhours through their aggregator. You may see push, SMS or email requests to approve connections from Yodlee or Plaid or Intuit in these scenarios. If you decline them, you run the risk of getting locked out of your KeyPoint account, and the data won’t be refreshed in your PFM.

You can also verify your account via SMS, email or voice call.

Still having trouble?

Call (888) 255-3637, click the Live Chat link during operating hours, or click here to request a call back—a Member Services Representative will contact you as soon as possible. You can also find our branch locations, hours and maps on our Locations page.

Alerts are sent through text or email and are a great way to keep track of your account activity and monitor your accounts for fraudulent transactions.

KeyPoint will send alerts using the following email and phone numbers:

| Alert Type | Contact Information |

| Card Services Alerts | Text “288472” |

| Debit Card Alerts | Text: “35515” Email: “[email protected]” |

| Other | Text: “888-691-5577” Email: [email protected] |

Accessing Mobile and Online Banking Internationally

If using Bill Pay:

Currently, a US-based phone is required to support multi-factor authentication (e.g., large dollar amount bill payments). While we are working of remediating this issue, please set up a Google Voice phone number to verify your account. Visit https://voice.google.com/.

If using Zelle®:

Zelle® requires both the sender and receiver to have a US-based financial institution. Additionally, if you do not have a US-based phone number, please use your email address to send and/or receive payments.

eStatements

To access your eStatements in Online Banking, simply click the More icon

Move Money

Remote Deposit allows you to deposit your checks using your smart phone any time, any place! Download KeyPoint’s mobile app and register for Mobile banking. Once logged in select Deposit and follow the prompts. You will be prompted to take pictures of the front and back of the check. Be sure to endorse the back and retain the check for seven (7) days for reference.

Please note the maximum daily check deposit amount is generally $25,000. Some checks may be subject to an extended hold. All check deposits are subject to collectability. For more information please see our Remote Deposit Capture Agreement or contact us at (888) 255-3637.

View how-to video: Mobile check deposit

A Zelle® QR code provides peace of mind knowing you can send money to the right person, without typing an email address or U.S. mobile number.

- Select “Pay with Zelle®” in Mobile or Online Banking and click “Settings” to see your QR code icon.

- To send money using a Zelle® QR code, simply point your camera at the recipient’s Zelle® QR code, enter the amount, hit “Send” and the money is on the way!

When sending money to someone new, it’s always important to confirm the recipient is correct by reviewing the displayed name before sending money.

NOTE: The QR code is not available within the Zelle® app.

Easily manage your Zelle® recipients at any time.

To sync your contact list:

- Open the KeyPoint Mobile app.

- Select “Pay with Zelle®” and click “Add or Select a Recipient” under “Quick Send.”

- Tap “Select from phone contacts,” allow access to your contacts and then select the individual you wish to send or receive money via Zelle®.

NOTE: The person sending you money will most likely have limits set by their financial institution.

Internal and External Transfers:

You can transfer money immediately between your KeyPoint accounts, accounts at other financial institutions or other individuals using their email or cell phone number.

Click on menu option “Make a Transfer” in Online Banking or “Transfer” in the Mobile app. For external transfers, the initial set-up of the external account is very simple and easy – it does however require additional verification steps and can take up to three business days to be completed.

For additional information please contact us at (888) 255-3637 or via live chat and our Contact Center Agents will be happy to assist you.

Internal and External Transfers:

You can transfer money immediately between your KeyPoint accounts, accounts at other financial institutions or other individuals using their email or cell phone number.

Click on menu option “Make a Transfer” in Online Banking or “Transfer” in the Mobile app. For external transfers, the initial set-up of the external account is very simple and easy – it does however require additional verification steps and can take up to three business days to be completed.

For additional information please contact us at (888) 255-3637 or via live chat and our Contact Center Agents will be happy to assist you.

Set up a transfer for a new external account:

Click on “Make a Transfer” in Online Banking or “Transfer” in the Mobile app. Next, click “External Account,” then click “Add” at the top righthand corner and “Add Ext. Account.” Follow the steps provided to find and log into your financial institution account.

Set up a transfer for an existing external account:

Click on “Make a Transfer” in Online Banking or “Transfer” in the Mobile app. Next, click “External Accounts,” select the “To” field and enter the transfer details. For recurring transfers, select “Frequency” and fill in the required information. Once complete, click the green “Transfer” button below.